⚓ Port Wars & Terminal Leverage: The Silent Battle Shaping Global Power

Ports may look quiet — ships come and go, cranes lift containers, and goods move in and out. But behind the peaceful image, ports are becoming some of the most important weapons in modern power politics.

Whoever controls a port controls trade. And whoever controls trade can influence economies, governments, and even military movements. This is the new battlefield — Port Wars.

1. Introduction: When Ports Become Weapons

For centuries, ports have been the lifeline of nations. Empires rose and fell on who controlled the seas and the harbors that supported them. Today, in the 21st century, ports are no longer just docks — they are geopolitical assets.

Think about it:

- 90% of world trade moves by sea.

- Every container ship needs a port to unload.

- Modern economies depend on smooth, fast shipping.

But ports are more than just trade hubs. They are also:

- Military launch points.

- Intelligence collection sites.

- Economic chokeholds.

- Leverage points in diplomacy.

Unlike aircraft carriers or missile bases, ports are quiet power tools. They don’t make headlines, but they can shift the balance of power.

2. Why Ports Matter More Than Ever

In the old days, countries fought wars over land and borders. Today, control of trade routes is just as important — sometimes even more. Ports sit at the heart of these trade routes.

Here’s why they matter:

🔹 1. Global Trade Runs on Ports

- Around 80–90% of global goods travel by ship.

- From oil and gas to electronics and food, everything depends on ports.

🔹 2. Energy Flows Through a Few Chokepoints

- Oil from the Middle East moves through terminals in the Red Sea, Indian Ocean, and Mediterranean.

- Control of these ports means control of energy supplies.

🔹 3. Military Power Needs Ports

- Aircraft carriers, destroyers, and troop ships need bases.

- A port gives a navy a launching pad to project power far from home.

🔹 4. Intelligence is Gathered in Ports

- Modern ports are wired with digital tracking systems, sensors, and data networks.

- Whoever owns the port can monitor movement, collect shipping data, and even track military vessels.

💡 Example: Djibouti is home to bases from the U.S., China, France, and Japan. Why? Because it’s at the Bab el-Mandeb Strait, a narrow chokepoint that connects the Red Sea to the Indian Ocean. Whoever holds Djibouti can watch over some of the world’s most important shipping lanes.

🏗 3. What Is Terminal Leverage?

Terminal leverage means gaining power not by owning land, but by controlling the infrastructure that moves global trade.

Instead of invading countries, modern powers lease or build ports in strategic places. This gives them:

- Economic influence — by controlling trade flows.

- Military options — by giving access points to fleets.

- Political leverage — by making host countries dependent.

Here’s how terminal leverage works:

- Owning or Leasing Ports

A country or company builds or buys part of a port. Example: China leasing Hambantota Port in Sri Lanka for 99 years. - Creating Trade Dependence

When a country relies on a foreign-owned port, the owner can apply pressure quietly. They can raise fees, slow shipping, or cut access in a crisis. - Military Access Without Bases

Ports can be used to resupply ships, even if they’re “civilian.” This gives strategic flexibility without formal military bases. - Data and Surveillance

Port operators have access to ship tracking systems, manifest data, and logistics flows. This gives them real-time intelligence.

📍 Case Study:

The Port of Piraeus in Greece was sold to China’s COSCO company. Within a few years, it became one of Europe’s busiest ports. China gained:

- A logistics foothold into the European Union.

- A political lever inside Greece and the EU.

- A soft military option in the Mediterranean.

That’s terminal leverage in action.

🛰 4. Global Hotspots of Port Competition

The race for ports is happening right now. Here are some of the key regions where major powers are competing:

| Region | Hotspot Ports | Key Players | Strategic Value |

|---|---|---|---|

| Indian Ocean | Djibouti, Gwadar, Chabahar | China, U.S., India, Iran | Energy routes and trade |

| Mediterranean | Piraeus, Haifa, Port Said | China, U.S., EU, Israel | Gateway to Europe |

| Red Sea | Jeddah, Port Sudan | UAE, KSA, China, U.S. | Suez Canal access |

| Africa | Mombasa, Lamu, Dakar | China, UAE, France | New logistics hubs |

| Latin America | Colon, Callao | U.S., China | Atlantic-Pacific link |

| Arctic | Murmansk, future ports | Russia, China | Emerging northern corridor |

These ports are like real-world chess pieces. Each move — each lease, each investment — shifts the balance of global trade.

💡 Notice something: China and the UAE are buying or building ports. The U.S. focuses more on access agreements and naval presence.

This shows two different strategies:

- Economic footholds vs. military partnerships.

🛡 5. Ports as Silent Weapons

Ports can be used as strategic weapons — without firing a shot.

How Ports Project Power:

- Deny Access: A country can block or limit a rival’s shipping.

- Control Supply Chains: Slow down goods, increase costs, or redirect flows.

- Surveillance: Track naval movements in real time.

- Political Pressure: Use economic dependence to influence decisions.

📍 Examples:

- UAE and the Red Sea: UAE-linked port operators influenced shipping patterns during Red Sea tensions, shifting trade flows quietly.

- Iran: Uses friendly ports to help its shadow tanker fleet avoid sanctions.

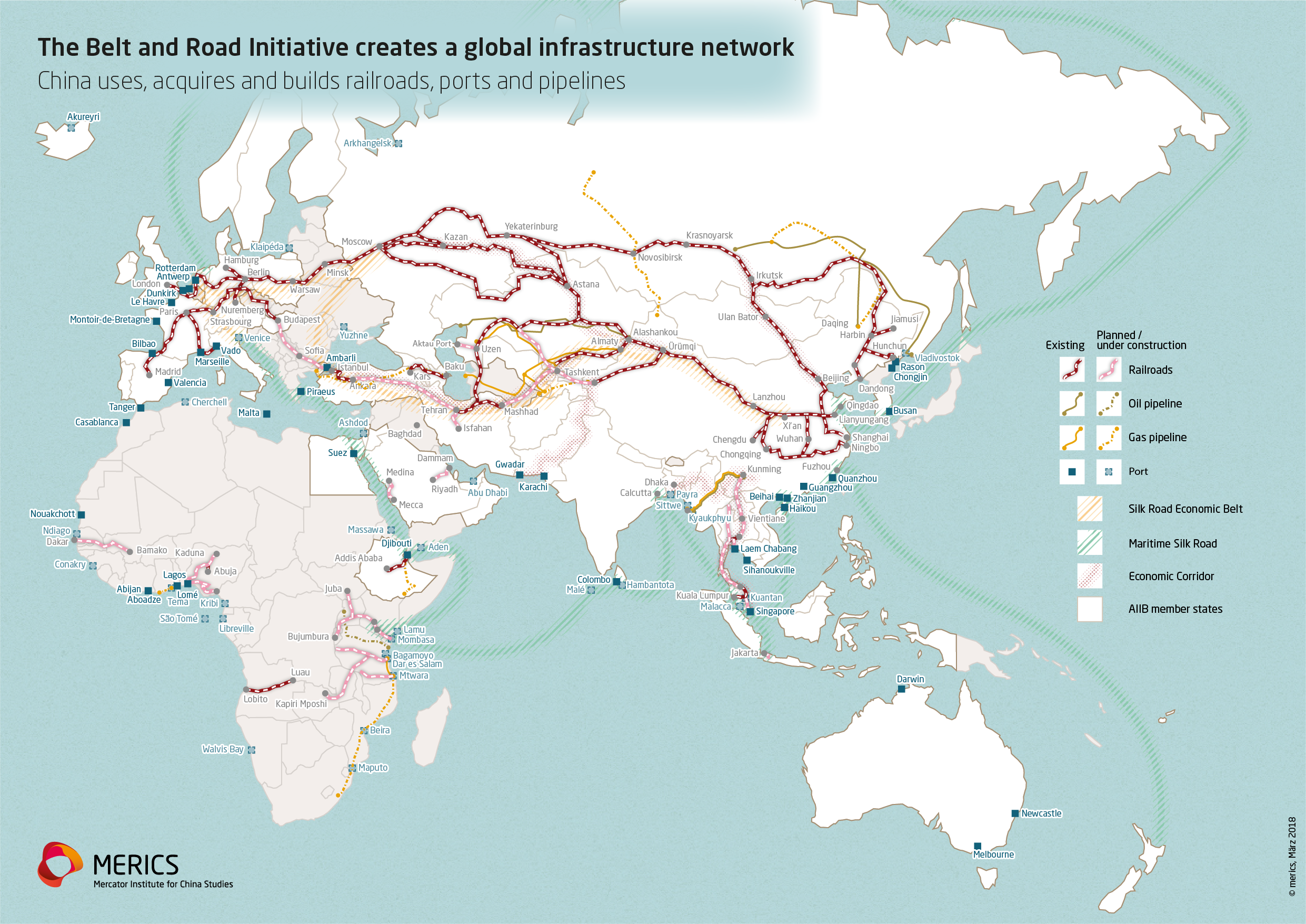

- China’s BRI Ports: Many Belt and Road ports are built as “dual-use” — commercial today, but easily usable by the navy tomorrow.

Ports give power without the political cost of war.

⚔️ 6. The “Terminal Wars” Between Powers

5

We can think of this as a “Cold War for ports.” Instead of tanks and troops, countries compete using:

- Cranes

- Leasing contracts

- Investments

- Logistics networks

Major Players in the Terminal Game:

🇨🇳 China

- Through the Belt and Road Initiative (BRI), China has invested in or controls over 90 ports worldwide.

- Strategy: Buy, lease, or build terminals to secure trade routes and gain strategic access.

🇺🇸 United States & Allies

- Strategy: Secure military access agreements and defense pacts rather than outright ownership.

- Focus areas: Mediterranean, Indo-Pacific, Red Sea.

🇦🇪 United Arab Emirates

- Through DP World and other companies, the UAE is quietly becoming a port power.

- Investments across Africa, the Red Sea, and South Asia.

🇮🇳 India

- Developing Chabahar Port in Iran to counterbalance China’s Gwadar Port in Pakistan.

🇷🇺 Russia

- Building Arctic ports as the Northern Sea Route opens due to melting ice.

- Also seeking footholds in the Mediterranean and Africa.

This competition is subtle but decisive. Controlling the right port can mean controlling:

- Regional trade

- Energy flows

- Military mobility

- Diplomatic influence

🧠 7. The Future of Port Wars

The next decade will bring even more competition over ports. But it won’t just be about who owns the land — it will be about who controls the data and logistics.

🌐 Key Trends to Watch:

1. Automation and Smart Ports

Ports are becoming highly automated, with AI systems, sensors, and real-time tracking. This means whoever controls the software may hold more power than the port manager.

2. Private Power Rising

Multinational companies like DP World, COSCO, and APM Terminals may end up with more leverage than some governments.

3. AI Logistics Control

Ports are linked through digital platforms. If one country dominates these platforms, it can influence global shipping flows.

4. Arctic Opportunities

Melting Arctic ice is opening new shipping lanes and potential ports. Russia and China are moving fast to control these routes.

5. Militarization of Civilian Ports

Many ports are designed to quickly convert to military use during a crisis. This dual-use model lowers costs and avoids public attention.

💥 If major chokepoints like Suez, Panama, or Malacca were blocked or captured, it could disrupt entire economies overnight — without war.

🧭 8. Strategic Chokepoints — The Real Power Nodes

Some ports matter more than others. These chokepoints are the keys to the world economy:

- Suez Canal (Egypt) – Link between Europe and Asia.

- Panama Canal (Panama) – Atlantic-Pacific shortcut.

- Strait of Malacca (Singapore/Malaysia) – Route for most of Asia’s oil.

- Bab el-Mandeb (Djibouti) – Critical Red Sea entrance.

- Gibraltar (Spain/UK) – Gateway to the Mediterranean.

Control over just one of these chokepoints can tilt the global balance. That’s why they’re hot spots in great power strategy.

📊 9. How Port Control Affects Ordinary People

It’s easy to think of port wars as something far away, but their impact reaches everyday life.

- When ports are blocked or pressured, prices rise.

- Shipping delays lead to shortages in stores.

- Energy routes disrupted = higher fuel costs.

- Political tension around ports can trigger global economic instability.

In 2021, when a single ship — the Ever Given — blocked the Suez Canal, global trade lost nearly $10 billion a day. Imagine if a port was blocked on purpose.

🧠 10. The Quiet Future of Power

Unlike the flashy displays of aircraft carriers or missiles, port control is quiet, long-term, and powerful.

This is why governments are:

- Building port partnerships

- Signing long leases

- Investing in port surveillance

- Linking AI logistics networks

Ports are no longer just docks. They are strategic power nodes.

And in the decades ahead, port wars may decide who leads the world economy.

📝 Conclusion: Control the Port, Control the Flow

Port wars are not fought with bullets or bombs.

They are fought with contracts, cranes, leases, and logistics systems.

The country — or company — that controls key ports:

- Controls global trade,

- Projects military power quietly,

- And shapes political outcomes far beyond its borders.

We often look at wars in terms of armies and weapons. But the real power may rest in harbors, terminals, and shipping lanes.

The battle for the world’s ports is already underway.

And most people don’t even notice it.